Despite the rough start to 2025, equity markets are showing signs of resilience in the face of policy uncertainty, geopolitical turbulence, and economic recalibration. The S&P 500 and NASDAQ Composite are only modestly lower year-to-date, while the Russell 2000 has lagged, signaling investor hesitation around cyclical sectors. Analysts attribute this unexpected market stability to encouraging developments in trade negotiations and a string of better-than-expected economic data points, which have helped calm recession fears that surfaced earlier in the year.

Yet beneath the surface, significant risks continue to simmer. U.S. fiscal concerns are mounting as federal deficits deepen. With Donald Trump’s multi-trillion-dollar spending bill known as the “Big, Beautiful Bill” advancing through Congress, investors are wary of its long-term implications. Bond markets have started flashing caution, and many analysts expect volatility to linger throughout the summer, especially as long-term interest rates shift and new economic data emerges. Although sentiment surveys hint at mild optimism, market participants remain largely defensive, awaiting stronger signs of economic acceleration before leaning into riskier assets.

On the global stage, trade tensions remain a critical focus. Trump’s decision to postpone a 50% tariff hike on EU imports until July 9 provided temporary relief to markets. Talks with EU leaders have resumed, with signs of willingness on both sides to reach a deal. Still, broader concerns persist around unresolved U.S.-China trade relations and ongoing instability in Eastern Europe and the Middle East. Russia’s latest aerial offensive in Ukraine, combined with Israel’s continued strikes in Gaza, has kept geopolitical anxiety high and safe-haven demand steady.

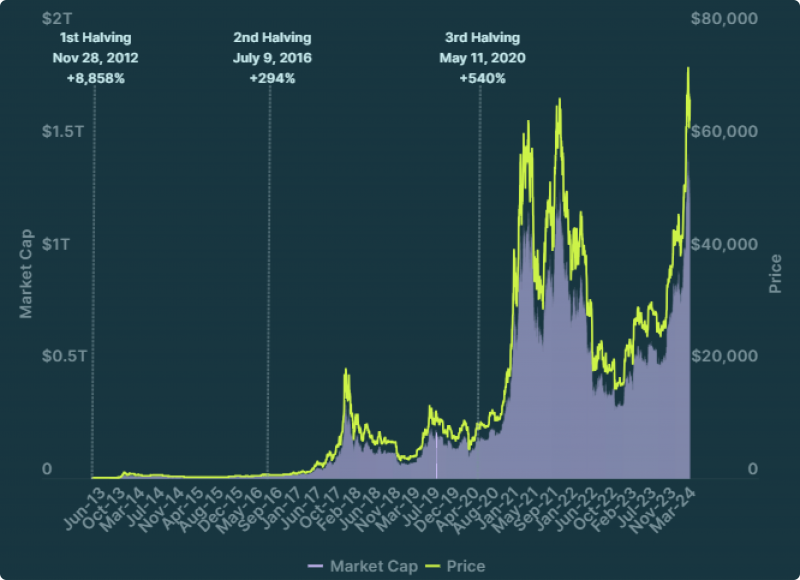

Meanwhile, Bitcoin continues its cautious rebound following a dip from record highs. Regulatory clarity appears to be a growing tailwind for the crypto market. Both the U.S. and Hong Kong advanced landmark stablecoin legislation last week, reinforcing a coordinated push toward oversight and legitimacy. In the U.S., banks are reportedly exploring the launch of a joint stablecoin initiative a move seen as a response to intensifying competition from the digital asset space.

Oil markets remain sensitive to both geopolitical signals and upcoming decisions from OPEC+. Brent crude prices eased slightly as investors brace for a potential output hike. Reports suggest OPEC+ could raise production by 411,000 barrels per day beginning in July. Simultaneously, Iran raised its official selling price for light crude, while President Masoud Pezeshkian insisted that the country could withstand failed nuclear talks with the U.S. a scenario that may restrict supply and offer some price support.

Looking ahead, all eyes are on the upcoming U.S. economic data releases including durable goods orders, consumer confidence, GDP, and the PCE price index as well as the FOMC minutes, which may hint at future rate decisions. Traders continue to price in the possibility of multiple rate cuts by year-end, contributing to a weaker dollar and bolstering assets like gold.

In a world full of political brinkmanship, shifting regulations, and uncertain economic footing, the market’s recent steadiness may prove fragile. For now, strategic caution remains the name of the game.

equity markets 2025, Bitcoin rebound, OPEC+ oil output, US-EU tariffs, Trump spending bill, US fiscal deficit, Iran nuclear talks, stablecoin regulation, FOMC minutes, gold price outlook, cryptocurrency regulation, oil price forecast, market volatility 2025, geopolitical risks markets.