Elon Musk has once again taken the spotlight, not for innovations in tech, but for his pointed criticism of President Donald Trump’s newly passed legislation—a sweeping tax and spending package Musk lambasted as a “disgusting abomination.” Using his platform on X (formerly Twitter), the Tesla and SpaceX CEO didn’t hold back, condemning the bill for ballooning the federal deficit and calling out lawmakers who supported it. “Shame on those who voted for it: you know you did wrong,” Musk posted, voicing deep frustration at what he described as wasteful and irresponsible fiscal policy.

The bill narrowly passed the House and includes broad tax reductions along with cuts to essential welfare programs such as Medicaid and food assistance. Despite its passage, it’s facing growing scrutiny in the Senate and among financial commentators. Critics like Musk argue that the legislation fails to present a viable strategy for long-term fiscal health, instead adding an estimated $2.7 trillion to the national deficit over the next decade. Supporters, however, insist that the tax cuts will stimulate enough economic activity to help offset the increased debt.

Musk’s remarks coincide with a tense moment in U.S. economic policy. He recently stepped down from his advisory role at the Department of Government Efficiency (DOGE), though his outspoken stance remains evident. Meanwhile, data from the JOLTS report showed a resilient labor market, with job openings surpassing forecasts. Yet, the strength of employment is doing little to stabilize the dollar, as concerns grow over rate cuts and inflationary pressure.

Federal Reserve members have been cautious. While Atlanta Fed President Raphael Bostic emphasized patience, others like Lisa Cook warned that increased tariffs could spark a stagflationary environment. This concern comes as Trump prepares for a pivotal call with Chinese President Xi Jinping, amid growing fears that trade tensions could escalate into another economic conflict. With new tariffs on steel and aluminum now at 50%, risks are mounting for both trade and inflation.

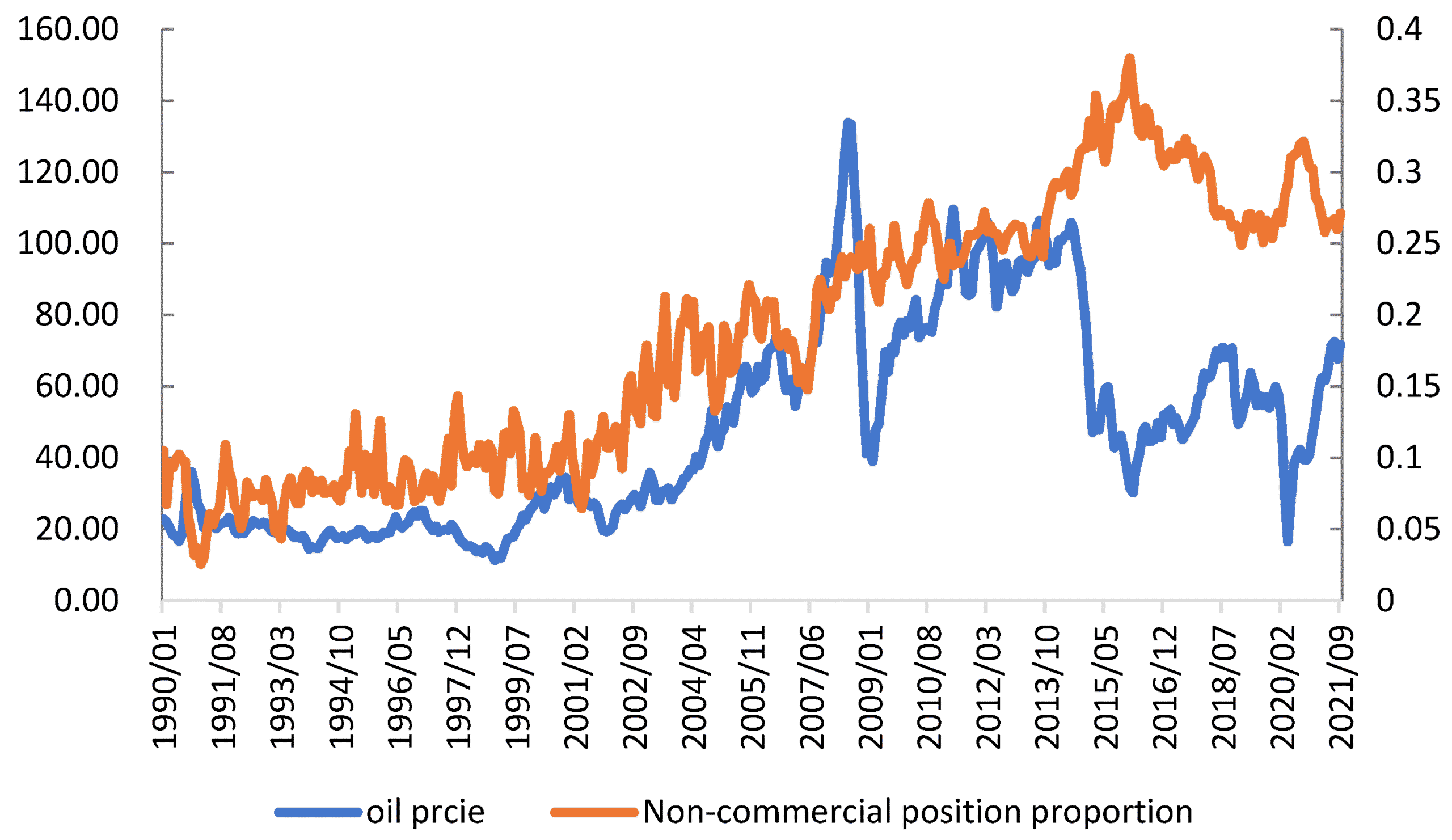

On the commodities front, oil markets remain volatile. Recent wildfires in Alberta and a stalemate in U.S.-Iran nuclear negotiations have raised supply concerns, but news of potential increases in OPEC+ output and tariff tensions have kept prices in check. Analysts suggest investors are cautiously waiting for signals of broader global stability before committing further.

With rising debt, uncertain trade relations, and a jittery oil market, the economic path ahead is anything but straightforward.

SEO Keywords: Elon Musk, Donald Trump spending bill, U.S. deficit 2025, JOLTS report April, Fed interest rate cuts 2025, U.S.-China trade war, oil prices 2025, OPEC+, Iran nuclear deal, economic volatility USA